In today’s consumer-driven world, the call to slow down, declutter, and focus on what truly matters has never been stronger. Embracing a minimalist lifestyle and simple living philosophy offers profound benefits for mental well‑being, financial health, and even the planet. By intentionally reducing possessions, streamlining routines, and adopting frugal living tips, individuals—especially those on low incomes—can cultivate a sense of freedom, purpose, and abundance. This comprehensive guide will define minimalism, explore its multifaceted rewards, share practical tips and tricks for living simply on a budget, and lay out a step‑by‑step plan to thrive financially and emotionally with limited resources.

Understanding the Minimalist Lifestyle

What Is a Minimalist Lifestyle?

Minimalism is the intentional practice of removing excess—be it physical possessions, commitments, or mental clutter—to make room for what adds genuine value to one’s life. Rather than a rigid set of rules, it’s a mindset that prioritizes essentials and experiences over acquisition and status.

At its core, minimalism invites us to question every purchase and habit: “Does this serve my values? Does it enhance my well‑being?” By focusing on intentionality, minimalists gain autonomy over their choices and align daily life with personal values.

The Pillars of Simple Living

Simple living extends minimalism beyond possessions to daily routines and relationships. It emphasizes:

-

Clarity: Eliminating distractions to improve focus and productivity.

-

Gratitude: Cultivating appreciation for what one already has.

-

Sustainability: Reducing environmental impact through mindful consumption.

-

Connection: Strengthening interpersonal bonds by prioritizing time and presence.

By weaving these pillars into everyday life, simple living becomes a holistic approach to wellness rather than a mere aesthetic.

The Benefits of Simple Living

Enhanced Mental Health and Focus

Clutter—both physical and mental—contributes to stress, anxiety, and decision fatigue. Studies show that reducing possessions and creating orderly spaces leads to improved focus, productivity, and overall well‑being.

Embracing minimalism can also foster greater life satisfaction by shifting attention from what’s lacking to what’s truly meaningful. As one psychologist notes, minimalism encourages autonomy, competence, and relatedness—key drivers of happiness in positive psychology research.

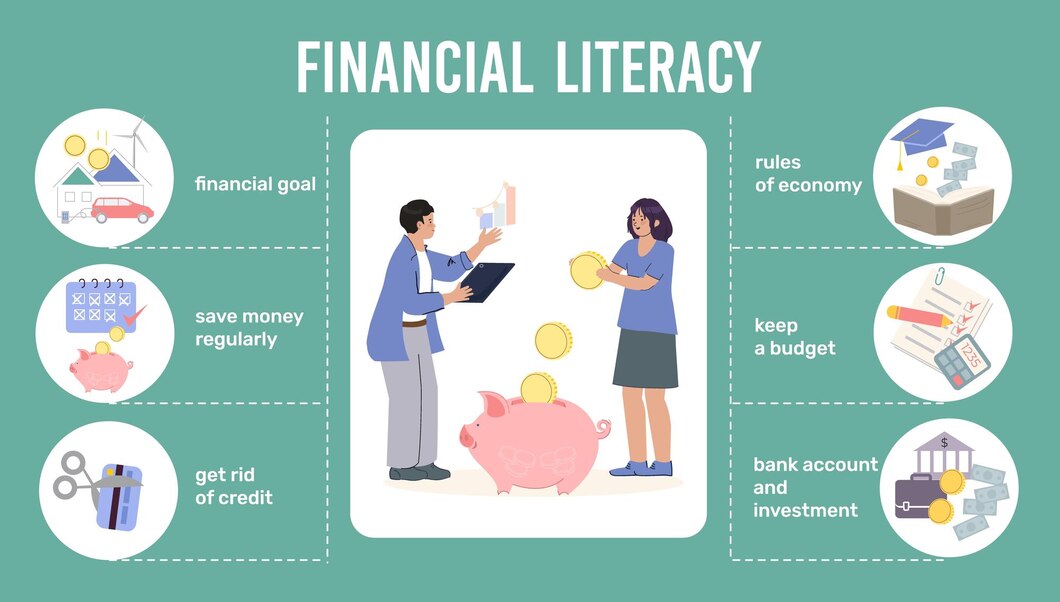

Financial Freedom and Frugal Living Tips

Adopting a minimalist lifestyle often goes hand in hand with frugal living. By cutting unnecessary expenses—impulse purchases, subscription clutter, or duplicate items—individuals free up funds for savings, debt repayment, and experiences that matter more than material goods. The financial rewards of decluttering include enhanced fiscal health, a sense of security, and accelerated progress toward financial independence.

Strengthened Relationships and Quality Time

Owning less often translates to having more time. Without the maintenance, cleaning, and management of excess possessions, individuals can redirect energy toward relationships, hobbies, or personal growth. Minimalism’s emphasis on intentional time use has been shown to deepen connections and foster more meaningful experiences with loved ones.

Environmental and Societal Impact

By consuming less and choosing sustainable options—such as secondhand goods—minimalists reduce their carbon footprint and textile waste. Fast fashion alone generates billions of pounds of clothing waste annually; thrifting and mindful purchasing help mitigate this environmental strain.

Frugal Living Tips for Low‑Income Minimalists

Living simply on a low income requires both creativity and strategy. Below are foundational frugal living tips that align with minimalism principles.

1. Master Your Budget: The 50/30/20 and Beyond

A clear spending plan is the cornerstone of financial control. The popular 50/30/20 rule recommends allocating 50% of after‑tax income to needs, 30% to wants, and 20% to savings or debt repayment. For tighter budgets, consider:

-

Zero‑Based Budget: Assign every dollar of income to a specific expense or savings goal, ensuring your income minus expenses equals zero.

-

Envelope System: Withdraw cash for discretionary categories (e.g., groceries, entertainment) and place it in labeled envelopes—once an envelope is empty, no more spending in that category until the next period.

2. Negotiate and Reduce Bills

Lowering recurring bills—utilities, insurance, phone plans—can yield substantial savings. Call providers annually to request discounts, switch to no‑frills plans, and bundle services when cost‑effective. Freeze subscriptions you rarely use, and consolidate streaming or cloud services.

3. DIY and Smart Outsourcing

While extreme frugality (doing everything yourself) can lead to burnout, strategic outsourcing can save both money and time. For example, paying for a meal kit or cleaning service occasionally may free up hours to work extra shifts or pursue side hustles that more than offset the cost.

4. Leverage Community Resources

Food banks, community gardens, and local swap groups provide essential support. ALICE TikTokers demonstrate feeding families on as little as $140–$190 per month by combining thrifted household products and food pantry hauls. Seek out charitable pantries and communal programs in your area to stretch tight food budgets.

5. Thrift, Swap, and Borrow

Thrifting is both eco‑friendly and budget‑friendly when done mindfully. Adopting a “one in, one out” policy prevents thrifted treasures from becoming clutter magnets—donate or sell an old item for every new item brought home. Swap children’s clothes, tools, or kitchen appliances with neighbors or via freecycle platforms.

Practical Tips and Tricks

Even within minimalism and frugality, practical systems keep progress sustainable and motivating.

Decluttering Methods to Keep Momentum

-

12‑12‑12 Method: Each day, discard 12 things, donate 12 things, and put away 12 things where they belong. This small‑daily goal makes decluttering achievable without overwhelm.

-

ETC (Edit the Cart) Method: Before any purchase, ask: “Does it solve a real problem? Am I influenced by marketing? Is this a habit purchase? Does it fit my priorities?” Passing these four checkpoints curbs impulsive spending and clutter accumulation.

-

Reverse Decluttering: First select only essential, loved, or frequently used items. Everything else falls into a “maybe” category, making disposal decisions psychologically easier by focusing on what to keep.

Meal Planning and Bulk Cooking

Batch cooking staples—rice, beans, soups—reduces grocery costs and food waste. Families of any size can save hundreds monthly by planning meals around sales, generic brands, and pantry staples. One mother of 12 uses Excel‑based shopping lists and coordinated store visits to keep her monthly grocery budget manageable, emphasizing price knowledge and multi‑store strategies.

Skill Swapping and Barter

Exchange skills like tutoring, child care, or home repairs with friends and neighbors. Bartering eliminates cash exchanges and strengthens community bonds—an invaluable asset when resources are tight.

Mindful Purchasing: The 10/10 Theory

Create two lists: your ten most expensive possessions and ten things that bring true joy (experiences or items). Reflect on what’s more valuable—often experiences win, guiding you to let go of costly but joyless possessions.

Creating Your Low‑Income Minimalism Plan

Below is a step‑by‑step roadmap to build a frugal, fulfilling minimalist life on limited resources:

| Step | Action | Timeline |

|---|---|---|

| 1. Assess Income & Expenses | Track all sources of income and monthly expenses using budgeting apps or a simple spreadsheet. | Week 1 |

| 2. Choose a Budget Framework | Adopt the 50/30/20 rule, zero‑based budget, or envelope system based on your comfort level. | Week 2 |

| 3. Set Clear Goals | Define financial (e.g., $500 emergency fund), decluttering (e.g., 20 items/month), and lifestyle goals. | Week 3 |

| 4. Declutter Strategically | Implement 12‑12‑12 or reverse decluttering in one room at a time to avoid overwhelm. | Month 1–2 |

| 5. Automate Savings & Tracking | Automate transfers to a savings account or secure envelope system; review spending weekly. | Month 1 |

| 6. Leverage Free & Low‑Cost Resources | Use libraries, community classes, food pantries, and online support groups for guidance and aid. | Ongoing |

| 7. Review & Adjust | Monthly check‑ins on budget, decluttering progress, and well‑being; tweak as needed. | Monthly |

| 8. Celebrate Milestones | Reward yourself non‑materially—like a nature walk or quality time with loved ones—when you meet targets. | Every 3 months |

Putting It All into Action

Immediate Steps

-

Spend 15 minutes identifying 12 items to trash, donate, or relocate.

-

Cancel or renegotiate one subscription or recurring bill.

-

Automate a small weekly transfer (even $5) to a savings envelope or account.

Monthly Check‑Ins

-

Balance your budget against actual spending and reallocate envelopes or percentages as needed.

-

Donate or sell items you haven’t used in six months.

-

Plan meals based on pantry staples and community resources.

Quarterly Reviews

-

Evaluate your emergency fund—target three to six months of essential living expenses.

-

Reassess goals: have your values or circumstances shifted? Adjust decluttering targets or financial priorities accordingly.

-

Reflect on gratitude: journal one thing you’re grateful for each day to reinforce minimalism’s psychological benefits.

Living a minimalist, frugal lifestyle on a low income is not about deprivation—it’s a pathway to freedom, focus, and fulfillment. By intentionally curating your environment, mastering your budget, and leveraging community resources, you can build a resilient, purpose‑driven life that celebrates simplicity over excess. Begin today: clear one drawer, cancel one recurring expense, and savor the profound sense of control and clarity that comes from owning—and needing—less.

Embrace minimalism not as an endpoint but a continuous journey of self‑discovery, gratitude, and intentionality. As you strip away the nonessential, you’ll uncover the true riches of a life lived simply and fully.